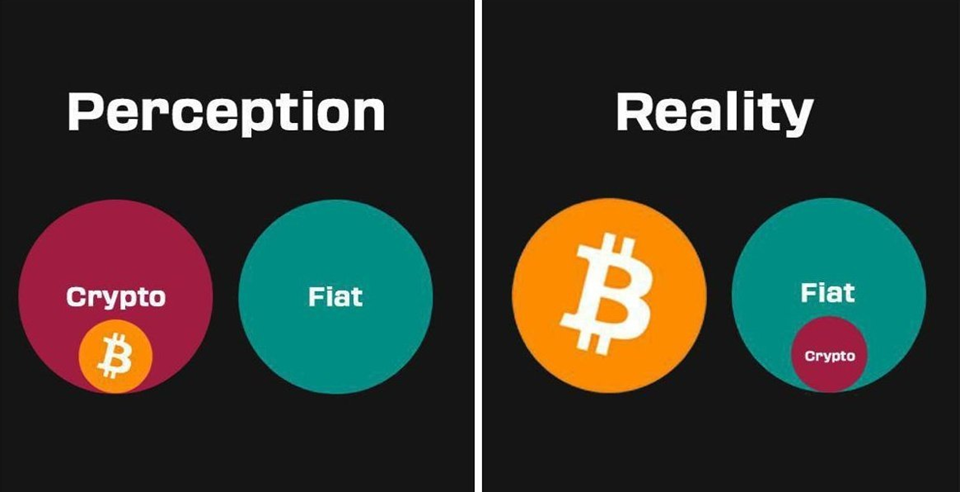

Bitcoin, Not Crypto: Discovering Absolute Scarcity

In a world of financial uncertainty and countless crypto scams, Bitcoin stands as a foundation of stability and certainty. With the discovery of absolute scarcity, Bitcoin shattered the boundaries of traditional finance, leaving behind a trail of crypto imitators seeking to divert attention away from Bitcoin. The following sections dive into six crucial factors that highlight why individuals and investors should prioritize Bitcoin as a means to safeguard their wealth from the dangers posed by fraudulent contenders.

1. Most Immutable Rules (21M):

Bitcoin stands apart from other cryptocurrencies due to its immutable ruleset, specifically its maximum supply limit of 21 million coins. This predetermined cap ensures scarcity, making Bitcoin’s supply schedule least resistant to future debasement. Unlike traditional fiat currencies, commodities, and cryptocurrencies subject to inflationary supply pressures, Bitcoin's fixed supply instills confidence in its long-term value proposition. This feature appeals to individuals seeking a store of value that cannot be diluted or manipulated by centralized authorities.

2. Battle-Tested Security and Reliability:

Bitcoin's security and reliability have been battle-tested over more than a decade. The Bitcoin blockchain has proven to be resilient against various attacks, showcasing its robustness. The network's distributed nature of full nodes, maintained by countless participants worldwide, ensures that no single point of failure can compromise its integrity. The combination of full nodes and miners working together establishes a trustless and decentralized system. Full nodes enforce the consensus rules, ensuring that all transactions adhere to the established protocol, while miners contribute computational power to finalize the settlement of transactions.

3. Unrivaled Liquidity:

Bitcoin is a digital asset that is easy and fast to buy and sell in large or small amounts all around the world. As Ludwig von Mises eloquently stated, "Those goods that were originally the most marketable became common media of exchange." This quote resonates with the exceptional liquidity of Bitcoin, underscoring its remarkable marketability and ease of sale globally. Bitcoin's widespread awareness and recognition have established it as the most desirable digital asset, capable of swift conversion into other forms of money regardless of geographical boundaries or time constraints. Its liquidity solidifies its position as a versatile and widely tradable medium of exchange, instilling confidence in users for seamless transactions for decades to come.

4. No Pre-Mine:

One of Bitcoin's distinguishing characteristics is that it had no pre-mine. Unlike many other cryptocurrencies, which may allocate a portion of tokens to founders or early contributors before being made available to the public, Bitcoin was introduced fairly. From its inception, the distribution of Bitcoin has been driven by mining, a proof-of-work process that rewards participants with bitcoin for contributing energy-intensive computational power. This equitable distribution ensures a level playing field and fosters a sense of trust and transparency among Bitcoin holders.

5. All Coins Distributed Through Proof of Work:

Bitcoin's distribution mechanism relies solely on the proof-of-work consensus algorithm. This means that miners must invest energy and computational power to mine a new block every ~ 10 minutes in order to finalize transactions and earn newly minted Bitcoin. This energy-intensive process ensures that new coins are created through a fair and competitive process, avoiding centralized control or manipulation. Bitcoin's reliance on proof of work has been proven effective, establishing its credibility and authenticity as the most decentralized digital asset.

6. The Irreplaceability of Bitcoin:

Bitcoin's irreplaceability is analogous to the concept of zero in mathematics. Once zero emerged, there was no need to create a better version of it; it simply existed as the foundational representation of nothingness. Similarly, Bitcoin's discovery of absolute scarcity established an immutable framework where the supply of 21 million coins cannot be surpassed. Just as you would use zero when needed, Bitcoin stands as the ultimate embodiment of scarcity, with no substitute capable of improving upon immutable scarcity.