Bitcoin: The Singular Investment Asset That No One Can Ignore

Over the past decade, Bitcoin has emerged as one of the most revolutionary technological advancement in modern history, arguably in the same tier as silicon computing and the internet. It is a decentralized digital money that is not controlled by any central authority, bank, or government. Instead, it operates on a peer-to-peer network that is maintained by decentralized node operators who verify and validate all transactions. Bitcoin has been referred to as “digital gold,” and for good reason. Like gold, it is scarce, durable, and fungible. But unlike gold, it is borderless, divisible, and can be transferred instantly and securely anywhere in the world.

Bitcoin's rise to prominence has been driven by a number of factors, including its unique characteristics and the growing distrust of traditional financial institutions. With the recent economic downturns caused by the COVID-19 pandemic, more and more people are beginning to see the potential benefits of Bitcoin as a safe-haven asset and a hedge against inflation.

In this blog post, we will explore the benefits of Bitcoin for modern society and why it is the singular investment asset that no one can ignore.

Decentralization and Freedom

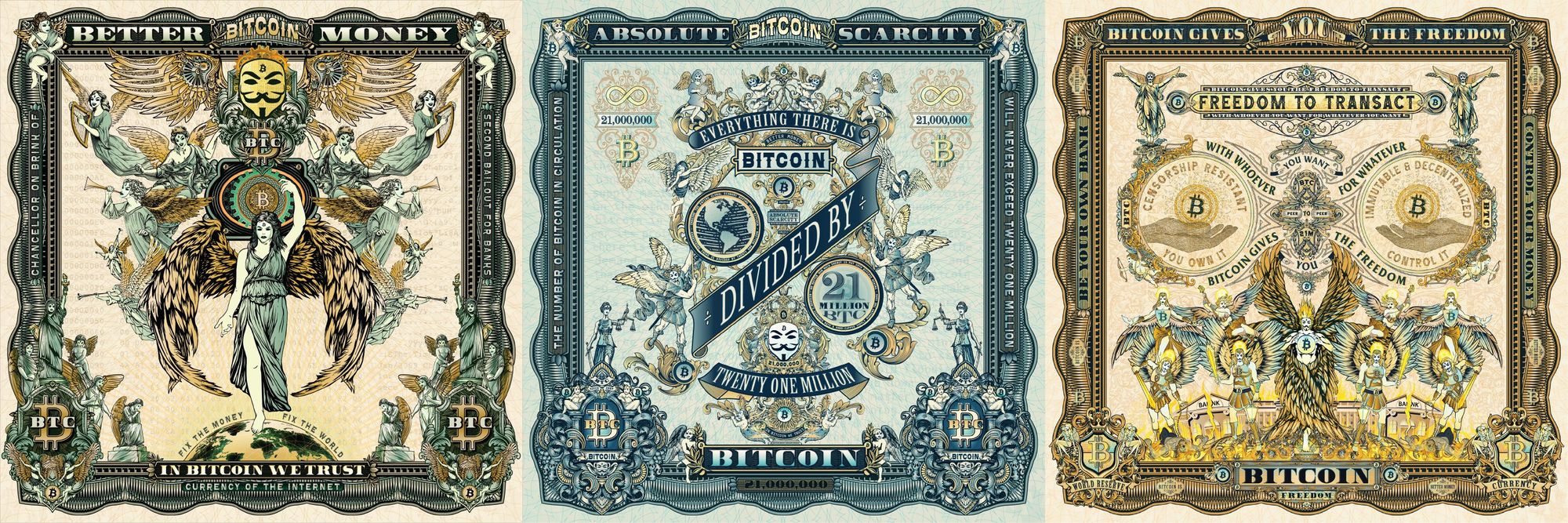

One of the key benefits of Bitcoin is its decentralized nature. Unlike traditional currencies that are controlled by central authorities, Bitcoin is a peer-to-peer network that is maintained by geographically distributed and decentralized node operators and miners. This means that it is not subject to the whims of governments or financial institutions, and it cannot be manipulated or inflated by those in power.

With Bitcoin, individuals can transfer funds to anyone in the world without the need for a third party or intermediary. This means that transactions can be conducted quickly, securely, and without the need for costly fees or bureaucratic red tape.

Protection Against Inflation

Bitcoin's most important feature is its limited supply. Unlike traditional currencies, which can be printed at will by governments and central banks, the supply of Bitcoin is fixed at 21 million. This means that it cannot be inflated or manipulated by those in power, making it a valuable asset in times of economic uncertainty.

Everything there is, divided by 21 million.

With the recent economic downturns caused by the COVID-19 pandemic, many people are concerned about inflation and the erosion of their purchasing power. Bitcoin offers a way to protect against this by providing a store of value that cannot be inflated or manipulated by those in power.

Accessibility and Inclusivity

Bitcoin is also highly accessible and inclusive. Unlike traditional financial institutions, which often require significant fees and bureaucratic hoops to jump through, Bitcoin can be accessed by anyone with an internet connection. This makes it a valuable tool for those who are unbanked or underbanked, as well as those who live in countries with unstable currencies or financial systems.

Security and Transparency

Bitcoin is also highly secure and transparent. Transactions on the Bitcoin network are recorded on a public ledger known as the blockchain, which is maintained by a community of users. This means that all transactions are transparent and can be verified by anyone, at any time. Additionally, the use of cryptography ensures that transactions are secure and cannot be manipulated or altered.

Potential for Growth

Finally, Bitcoin offers the potential for significant growth and returns in purchasing power. While Bitcoin has experienced significant volatility in the past, its long-term trajectory has been upward. As more people begin to adopt and use Bitcoin, its value is likely to continue to rise. Additionally, Bitcoin's scarcity ensures that it will remain a valuable asset in the long term, making it a wise investment for those who are looking to diversify their portfolios.

Overall, it is becoming increasingly apparent that Bitcoin stands as an asset class that commands the attention of every type of capital allocator in the world. Its singularity stems from a set of traits that position it as a remarkably suitable store of value. Bitcoin's design - a capped supply, ease of transfer, security, and decentralization - deftly addresses the pitfalls of traditional investment assets, such as gold and real estate, while outperforming the advantages offered by fiat currencies like the US dollar.

Beyond its operational virtues, Bitcoin emerges as a potent hedge against the specter of inflation and the steady debasement of currency by central banks, which are ever-increasing concerns in today's monetary landscape. These inflationary tendencies are innately counteracted by Bitcoin's hardcoded supply limit, ensuring that the dilution of value isn't a threat to those who hold Bitcoin.

In a world fraught with economic uncertainties and geopolitical complexities, Bitcoin carves a niche for itself as a beacon of stability and predictability. Its unique convergence of technology and economics propels it to the forefront of potential investment assets. Therefore, for those in search of a store of value that is resilient to the whims of inflation and monetary manipulation, Bitcoin represents a voluntary yet compelling option for storing wealth.