Bitcoin vs. Gold

Theya is the world's simplest Bitcoin self-custody solution. With our modular multisig vault, you decide how to hold your keys.

Whether you want all your keys offline, shared custody with trusted contacts, or robust mobile vaults across multiple iPhones, it's Your Keys, Your Bitcoin.

Download Theya on the App Store.

When it comes to preserving wealth and purchasing power over extended periods, two assets have captured the attention of individuals and institutions worldwide: Gold and Bitcoin. Gold is a precious metal and a traditional store-of-value asset that has stood the test of time and maintained monetary significance for more than 5,000 years.

Bitcoin is a digital currency that improves upon gold’s strengths while retaining none of its weaknesses. It’s no surprise that Bitcoin has earned the nickname ‘digital gold’ and is seen by many as the future of money due to its many similarities with this traditional store of value asset. In this article, we will explore these safe-haven assets’ striking similarities, intriguing differences, and the compelling case that makes gold and Bitcoin valuable assets in a world grappling with monetary inflation.

Historical Significance

Gold boasts a remarkable history, serving as a form of money and a store of value for over 5,000 years. Its long history can be traced back to ancient Sumerian and Egyptian civilizations which used gold for trade and ornamental reasons. Gold maintained a role as money to varying degrees throughout history until the US suspended the Dollar’s convertibility to gold in 1971.

This marked the beginning of the fiat currency system, under which the US Dollar had no tangible backing. Despite its declining use as a medium of exchange today, its long history of monetary significance has solidified gold as a traditional store of value and one of the oldest forms of money.

In contrast, Bitcoin is a relatively recent innovation. It was first introduced in 2009 by the pseudonymous creator Satoshi Nakamoto. Despite its limited history, Bitcoin has gained enormous traction in a relatively short period due to its emergence in the digital age and its unique properties. In Bitcoin's 15 years of existence, it has demonstrated remarkable resilience and functionality. While Bitcoin may take more time to establish credibility and longevity in the minds of individuals, its superior monetary properties make it a compelling investment choice.

The Properties of Money

- Scarcity: Money gains value through its scarcity, meaning there is a limited supply, enhancing its desirability and ability to serve as a medium of exchange.

- Portability: Money must be easily transportable, allowing for convenient transactions and widespread use in various economic activities.

- Divisibility: Money's divisibility ensures it can be broken down into smaller units, facilitating transactions of varying sizes and contributing to its versatility.

- Fungibility: Money is fungible when each unit is interchangeable with another of the same value, promoting uniformity and seamless transactions within the economy.

- Verifiability: The authenticity and value of money should be readily verifiable, enabling users to confirm its legitimacy and trustworthiness in the economic system.

Scarcity

In economics, scarcity refers to the limited availability of an asset and therefore is a fundamental driver of value. Gold is a great example of a scarce commodity. Gold’s scarcity arises due to its geological rarity, the difficulty in finding new deposits, and the inability to replicate it synthetically. In other words, the only way to get more gold is to mine it. Even with our advancing technological capabilities, the supply of gold only expands by around 2% annually.

On the other hand, Bitcoin introduced absolute scarcity. This means there is a fixed and unalterable number of Bitcoin that can ever exist, set at 21 million coins. This unique to property has earned it the nickname ‘digital gold.’ While gold has a slowly expanding supply, Bitcoin is limited to a maximum number of 21 million coins. This elevates Bitcoin's scarcity above that of gold making it an attractive choice for storing wealth.

Both gold and Bitcoin respectively have witnessed extraordinary returns, driven in part by their inherent scarcity. Their appeal as a store of value has grown significantly in recent decades, especially given the ongoing devaluation of fiat currencies.

Portability and Divisibility

The primary limitations of gold, which have hindered its ability to serve as money in increasingly complex economies, can largely be attributed to its lack of portability and divisibility. While gold has done a tremendous job of retaining its value over the long term, its lack of divisibility and the difficulty of carrying it around physically have led to its replacement by more portable and divisible forms of money such as fiat currency. While the use of gold coins and paper notes redeemable for gold mitigated this problem for a time, this came with limitations as well. Primarily, the impracticality of small transactions and the issuance of paper notes well beyond their gold backing led to various problems over time.

In contrast, Bitcoin represents a breakthrough in portability and divisibility. Its digital nature makes it extremely portable in both large and small denominations. You can bring your Bitcoin anywhere with you simply by carrying your smartphone or memorizing your private keys, which eliminates the need for any physical presence or storage.

Bitcoin also boasts exceptional divisibility. Each Bitcoin I divisible into 100 million subunits called ‘satoshis.’ This high degree of divisibility renders Bitcoin extremely efficient for purchases of all sizes, whether buying a home or enjoying a cup of coffee at your local café.

Fungibility and Verifiability

Fungibility and verifiability are two important qualities that determine the practicality of using any asset as money or a store of value. If something is fungible, one unit of the asset can be exchanged or substituted for another unit without any impact on its worth. Verifiability refers to how easy it is to determine whether the asset you possess is authentic.

For example, fiat currency is highly fungible. Consider a $20 bill, each of these bills is fungible, meaning that it can be replaced with another $20 bill and the value remains the same. In this way, fungibility ensures each unit of an asset is equally valuable, a necessary precursor for it to be used in monetary transactions.

Gold is considered a fungible asset. Its chemical properties make it uniform and indistinguishable, regardless of its source or form. Where gold falls short is its verifiability. For the average person, it is generally quite hard to determine the purity and authenticity of gold. Typically, you would need to consult a professional opinion on the matter, which results in an additional expense.

Bitcoin is highly fungible as well, meaning one Bitcoin is equal to any other Bitcoin. Additionally, Bitcoin excels in its verifiability, which is achieved through its transparent blockchain. Each Bitcoin transaction is recorded on the blockchain, allowing any of its participants to easily verify its authenticity and validity. This is just one of the ways that Bitcoin enhances trust as a monetary network and eliminates the need for third-party involvement.

In summary, both gold and Bitcoin are fungible assets. Where they differ most is with the ease of their verification process. While gold requires a physical verification process, Bitcoin achieves more efficient verifiability through its transparent blockchain.

The Importance of Self-Custody

Another challenge with gold is the difficulty and cost of securely storing it. While it is straightforward to hold a small amount of gold, the same cannot be said for securing substantial wealth in gold, such as through gold bars. Storing physical gold comes with a host of challenges, likely involving outsourcing the storage of your gold to a third party, which introduces counterparty risk and an additional expense

The challenges of securing gold contributed to its decline as a practical form of money. Individuals seeking higher security turned to banks to hold gold on their behalf. Over time, gold became centralized in banks and bankers began to issue paper notes redeemable for the gold held in their vaults. This marked a pivotal moment in gold's history. Gold's inherent limitations in terms of portability, divisibility, and storage led to its centralization among financial institutions and contributed to its gradual decline as money and the end of the gold standard.

In stark contrast, securing and storing Bitcoin is remarkably easy. Bitcoin is a digital bearer asset and you can secure it simply by writing down or memorizing a set of 12 words known as your ‘seedphrase.’ This is referred to as self-custody and is one of the aspects that empowers Bitcoin users well beyond any means in traditional finance. By holding the keys (think 12 words) to your Bitcoin, it can't be confiscated from you and enables you to send uncensored transactions globally. The ease of securing Bitcoin paired with its excellent portability and divisibility positions Bitcoin as a truly transformative asset in the modern economy.

Bitcoin vs. Gold: Which is Better?

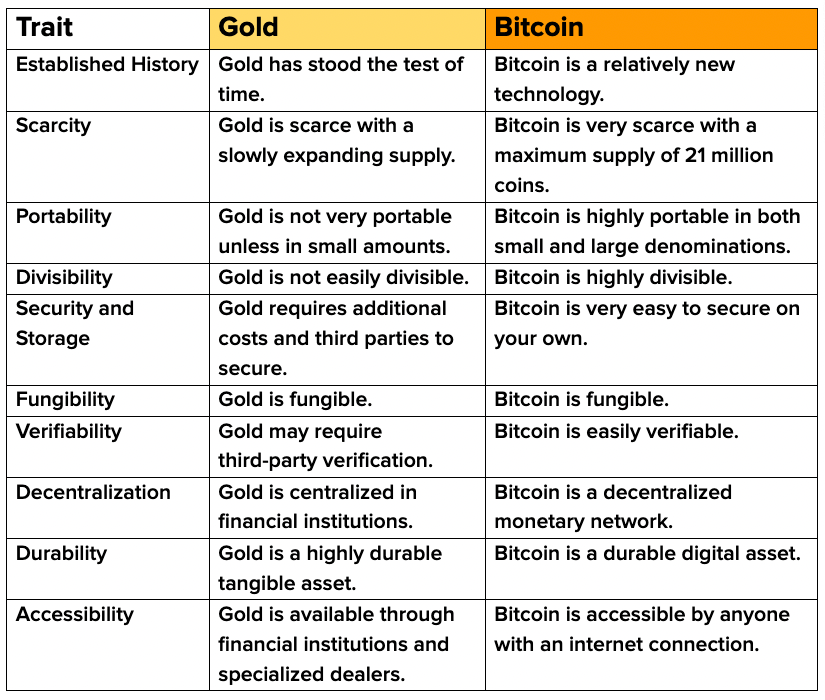

In the following table, we’ve summarized the key findings of this article to help understand the differences and similarities between gold and Bitcoin.

In conclusion, we aimed to highlight the strengths and weaknesses of two assets, gold and Bitcoin, each possessing its own unique properties.

Gold, with its established history, physical nature, and scarcity, has cemented itself as a reliable asset and store of value for traditional investors. Its long history makes it a reliable choice for those seeking stability and wealth preservation.

On the other hand, Bitcoin has emerged as a new and innovative contender in the store of value space. Its digital nature, limited supply, portability, divisibility, accessibility, and ease of verification present a compelling case for modern investors seeking to empower themselves further and explore this digital revolution. Ultimately, there is no one-size-fits-all answer. Both gold and Bitcoin exhibit monetary properties that make them excellent stores of value and inflation hedges, offering investors diverse options when exploring how best to preserve their wealth in different financial landscapes. The choice between the two will ultimately depend on individual preference, your investment strategy, and the evolving economic landscape.

Download Theya on the App Store.