Evolution of Bitcoin Self-Custody: A Historical Timeline

Self-custody of Bitcoin has often been perceived as a challenging task, but in reality, it is no different from adopting any other transformative technology. Just like setting up a wifi router, using an email address, joining a bank, or learning to drive a car, self-custody requires familiarization with new concepts. While managing private keys may seem unfamiliar to most, the process has become significantly easier over the years. This report provides a timeline of the evolution of Bitcoin custody, showcasing the advancements that have simplified the self-custody experience.

Initial Years: Private Keys and Command Line (2009-2011)

During the early years of Bitcoin, self-custody involved directly holding private keys. Each private key corresponded to a single Bitcoin address. However, this required users to operate through command line interfaces, which presented a considerable barrier to entry for many. This initial approach demonstrated the foundational aspects of Bitcoin and self-custody but lacked the user-friendly interfaces necessary for widespread adoption.

Bitcoin-Qt and Casascius Coins (November 2011)

In November 2011, Bitcoin-Qt, a user-friendly software wallet, was introduced. This marked a significant step towards simplifying self-custody. Bitcoin-Qt provided a graphical interface, making it easier for users to manage their private keys and Bitcoin addresses. Additionally, during this period, physical Casascius coins were created by Mike Caldwell, featuring private keys hidden beneath a holographic seal. This physical representation added a tangible layer of security and familiarity to self-custody.

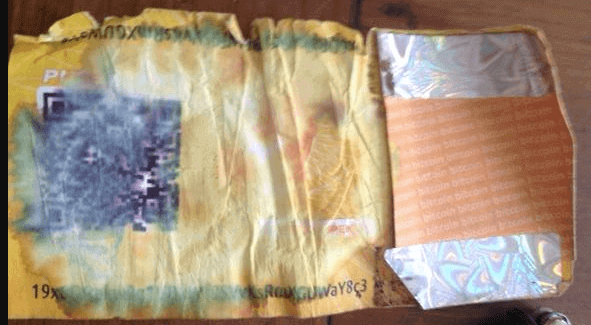

Paper Wallets and Electrum (2011)

In 2011, the concept of paper wallets emerged, allowing users to generate private keys, print them on a piece of paper, and include a corresponding Bitcoin address and QR code. This made it easier for individuals to store their Bitcoin offline securely. Paper wallets served as an accessible and low-tech solution for those who preferred a physical representation of their Bitcoin. Another popular software wallet, Electrum, was also released in 2011. It provided a straightforward user interface, enabling users to generate private keys, receive BTC, and sign transactions.

Bitcoin Multi-Signature Support (2012)

In 2012, Bitcoin introduced BIP (Bitcoin Improvement Proposal) 0011 and BIP 0016, enabling multi-signature support directly within the protocol. This feature allowed users to generate multiple private keys, merge them into one Bitcoin address, and require multiple signatures for future spending. As Bitcoin's value increased to over $5.00 at the time, this feature became critical for enhancing security. It provided users with greater control over their funds by requiring the cooperation of multiple private keys for transaction authorization.

Mnemonic Seed Phrases (2013)

BIP 0039, implemented in 2013, revolutionized self-custody by introducing mnemonic seed phrases. Instead of recording each individual private key, users could now memorize or write down a 12 or 24-word phrase encompassing all their private keys. This significantly simplified the process of backing up and restoring wallets. Mnemonic seed phrases made it easier for users to recover their funds, as the phrase is human readable and can generate millions of private keys. This development greatly improved the user experience and security of self-custody.

Hardware Wallets (2013)

In 2013, Satoshi Labs launched the first hardware wallet, Trezor. Hardware wallets revolutionized self-custody by generating private keys on offline devices and securely signing transactions. These devices, including Ledger and Coinkite, offered compatibility with various software wallets, providing users with flexible options for managing their Bitcoin securely. Hardware wallets ensured that private keys remained isolated in cold storage from potentially compromised devices, reducing the risk of unauthorized access and theft.

Collaborative Multi-Key Vaults (2016-2017)

Before the peak of the 2017 bull run, companies like Unchained and Casa emerged, aiming to make multi-key vaults more accessible. Leveraging the growing popularity of hardware wallets, these platforms simplified the implementation of multi-signature setups. This development allowed users to secure their growing Bitcoin holdings without compromising usability. Collaborative multi-key vaults provided an added layer of security by distributing private key control among multiple participants, reducing the risk of single points of failure or malicious actors compromising individual keys.

Collaborative Vaults with Native Digital Experience (2023)

In 2023, a new player called Theya is entering the scene, launching a simplified Bitcoin multi-key vault. Theya's solution allows users to utilize hardware wallets or even their iPhones, making self-custody seamless, secure, and redundant. By combining the convenience of digital experiences with collaborative multi-key vaults, Theya is set to further simplify self-custody for Bitcoin users. Their platform ensures a user-friendly approach while maintaining the highest levels of security and redundancy.

The history of Bitcoin custody demonstrates a gradual evolution toward simpler and more user-friendly solutions. From the early days of command lines and paper wallets to the introduction of mnemonic seed phrases, hardware wallets, and collaborative vaults, self-custody has become increasingly accessible. As technology continues to advance, more innovations are likely to emerge, driving Bitcoin's adoption and making self-custody an effortless endeavor for all. The journey towards secure self-custody has progressed significantly, and with platforms like Theya entering the market, the future holds promise for even more streamlined and convenient Bitcoin storage solutions.